We did it people! Finally, we have an answer to Nigeria’s pesky revenue problem and who would have thought that the answer would be something that has always been with us. Taxation is not a new concept to the Nigerian reality and it just might be the cure to all our budget deficit issues and our borrow borrow that doesn’t seem to make us shine.

The good thing about taxation is that it comes in different flavors depending on your taste: there is a direct tax for people that are straightforward and do not hide their ‘agenda’ and an indirect tax for foxy individuals that like to play mind games. Both direct tax and indirect tax have sub-divisions, making taxation a fully loaded weapon.

It should be noted that when something is termed ‘the new gold’ it generally suggests that the item, hopefully, can generate wealth and improve the condition of the owner.

The term also brings to mind the gold rush that happened in the early days of the United States of America, where people left their homes, got loans and traveled to various promised gold sites with the aim of making it big. Many gold dreams were shattered as the reality did not match what most dreamed of, a situation that can be said to fit the last thing that was termed ‘the new gold’ in Nigeria.

In the year 1956, oil was found in Oloibiri, Nigeria and so was born the country’s ‘new gold’ or ‘the new black gold’ as it was called. Oil promised to change the landscape of the country for the better. Money from oil was fast and plenty. There was now no need for the government to stress themselves on sectors like agriculture or manufacturing when the government could easily give out licenses to oil companies and boom money starts coming in. Traditional sectors like agriculture could not keep up.

Nigeria, like the prospectors of the US gold rush started dreaming big as this newly found wealth had the potential to change everything- or so we hoped. Hooked on money from oil, the country forgot that the value of oil would not always be constant and that it would be better to rely on a more sustainable means of funding. Somewhere along the line, corruption, wastage and environmental destruction were used to replace the promise of economic growth and development that this new found wealth promised and so, ‘the new gold’ turned out not to be a blessing but a source of distraction to the goals of the country.

Nigerian’s relationship with oil should therefore place caution on any item being called ‘the new gold’ let alone a complex item as taxation. Taxation methods should therefore be properly studied and put in place with Nigeria’s peculiarities in mind and not rushed into because of the ‘the new gold’ promise it appears to hold.

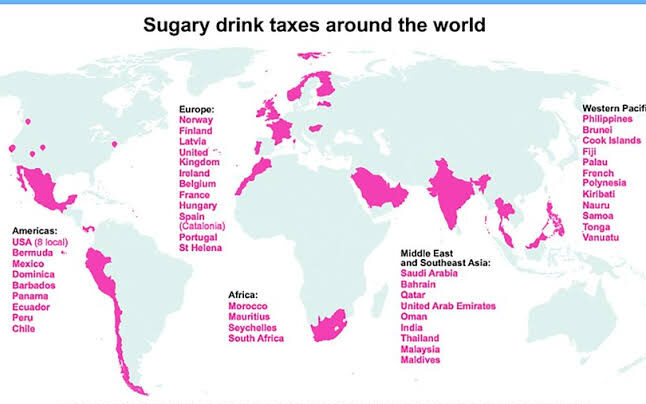

Also, given that Nigeria would not be the first country to aim to rely on taxation as its main source of revenue, it would do the country some good if it could copy tax strategies of other countries and voila mission accomplished. Sadly, copying without consideration of the local landscape is a recipe for disaster leading to a worse situation than before. Nigeria cannot just copy its way into achieving its taxation goals but most take into proper consideration the uniqueness of the Nigerian situation.

The promise of taxation is exciting but can only work if the social contract of the nation is reworked and the citizens are convinced into believing that the cycle of corruption that was fueled by money from oil will now not be fueled from taxation. This can only happen when there is accountability, responsiveness and performance on the part of the government as the people would want to know and see what exactly their money is being used for. Policy makers would also have to commit themselves to tax policies that would not make the poor poorer but will be fair, transparent and based on the taxpayers relative ability to pay.

The hope is that with a fully renewed social contract the people would have faith in the government and then taxation can truly be ‘the new gold’. With proper implementation taxation can break free from the shackles of past ‘new gold’s’ and become the bedrock of development in the country.

Tax, the New Gold! Read More »