Introduction

Many think, and rightly so, that our culture on this side of the world disproportionately favours one gender (male) over the other (female). If their thinking is true, and it is, then is it possible the native bias has far-reaching implications on even more western-influenced structures like our tax system? Let’s find out.

Firstly, women generally earn lower incomes than men. This truth is magnified when you look through the lens of the Nigerian gender income inequality. For instance, in a Gender Gap Assessment of 30 leading Companies listed on the Nigerian Stock Exchange, it was discovered that no Company achieved gender balance (60-40%) in all 4 workforce levels (board, executive, senior management, and workforce) of the company. What’s more, is the fact that they’re not even close to reaching it. At the board level, for instance, it’s 77% male to 23% female.

Also, women generally constitute most of the informal sector. If the women are not participating in agricultural subsistence activities, they would find themselves in some other form of informal employment of the nature of self-employed, casually or seasonally paid, often unskilled and physically demanding jobs with minimal productivity and offering little opportunity to improve one’s skills and move higher in the income ladder. This is equally true in a country like Nigeria where cleaning and house help jobs for example have as many feminine undertones as they do little compensation.

The Gendered Nature of Our Tax System

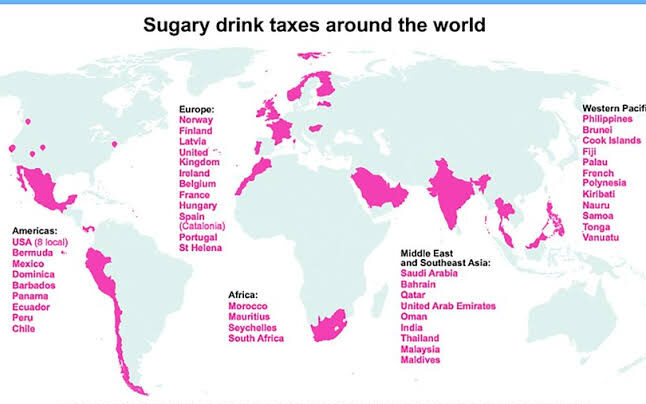

- Implicit And Explicit Bias: Explicit bias, by nature, is manifestly evident by simply skimming through the contents of particular rules, regulations, and legislation. Implicit bias however is more subtle as the regulations, at face value, appear impartial to the different genders but become so upon application of the said regulations. This is for instance seen in the case of VATs. Due to pre-existing gender norms, women tend to expend their income on household goods and essential services like food, sanitary products, education, health care (for children), and so forth. Generally, VAT frameworks often include reduced rates, zero-rate VATs, or exemptions which altogether reduce the fiscal burden on specific goods and services. However, when these incentives are not applied to essential goods and services such as diapers, cooking fuel, and sanitary pads most of which women purchase with their income, VAT becomes discriminatory in its application. This is worsened by the fact that women generally earn lower incomes.

- Gender Disparity in Fiscal Administration: When it comes to making laws and policies governing fiscal administration in Nigeria, it would seem the only hope for women to have gender-responsive fiscal laws and policies lies in the strength of the minority women in the administrative offices as well the uncertain support of compassionate men in such offices. That hope, it must be pointed out, does not seem to have gotten us anywhere thus far. This means the time for restructuring is overdue.

Recommendations

- Discouraging Pink Tax: Pink tax is a form of gender-based pricing where women are typically charged more for feminine products. Women typically pay far more for generally identical products made by the same manufacturers. This happens on more than 40% of all goods sold where women still have to pay sales tax on feminine hygiene products like tampons and pads. Despite being necessary products (which usually go untaxed), they’re categorized as luxury products. Eliminating VAT on feminine products will thus bridge the inequality gap where males get their products at a normal price alongside females. With these, the payment of tax will be balanced between both genders.

- Adopting a gender-balanced tax system: This includes establishing a gender-responsive budget to ensure tax revenue is spent in a way that promotes gender equality – giving all women a say in how public money is spent.

Also, carrying out tax impact assessments to identify the direct and indirect effects of taxes by gender, paying particular attention to the impacts of both taxes and public spending on the poorest women. An annual survey should be taken with emphasis on the effect of tax by gender before the next year’s budget is drafted so any impartiality will be treated by either reducing taxes on the product or providing an alternative mechanism to ensure a gender-equal tax system.

Funny how women are regarded as the weaker gender but are viewed as stronger when it comes to tax payments. Equality is far from taxing both rich and poor the same way, there should not be a disparity between men’s and women’s tax payments.

Bibliography

- Role of Taxation in promoting gender equity: World Bank (PDF)

- How tax reform can promote growth and gender equality, available at https://www.tax-platform.org/news/blog/Tax-Reform-Gender-Equality-in-the-Post-COVID-Era

- Equal Pay For Work of Equal Value, available at https://www.unwomen.org/en/news/in-focus/csw61/equal-pay

- Gender Equality in Nigeria’s Private Sector: A Gender Gap Assessment of 30 Leading Companies on the Nigerian Stock Exchange, Equileap’s 202 Global Dataset

- Leah, F. (1996) Women in the Informal Sector, Development in Practice, 6(1), 25-36 as cited in Nguyen, Linh T. (2015), “Education and Women in the Informal Sector: A Cross-country Analysis,” Undergraduate Economic Review: Vol. 12, Iss. 1, Article 2. Available at https://digitalcommons.iwu.edu/uer/vol12/iss1/2

- Gerlinde Theunissen et al, Gender and Taxes: The Gendered Nature of Fiscal Systems and the Fair Tax Monitor, (OXFAM 2019)

A gender-responsive tax system: a nigerian truth or farce? Read More »