By Orire Agbaje

New year! New taxes! One of the taxes introduced by the Finance Act is the Sugar tax. This means that Nigeria will now impose tax on your favorite soda drinks – maybe you should consider starting a #NoSodaChallenge🚫🥤.

The Minister of Finance, Budget, and National Planning, Zainab Ahmed, asserted that the rationale behind the Sugar Tax is to generate revenue for the FG’s budget and tackle the growing obesity and diabetes menace in Nigeria.

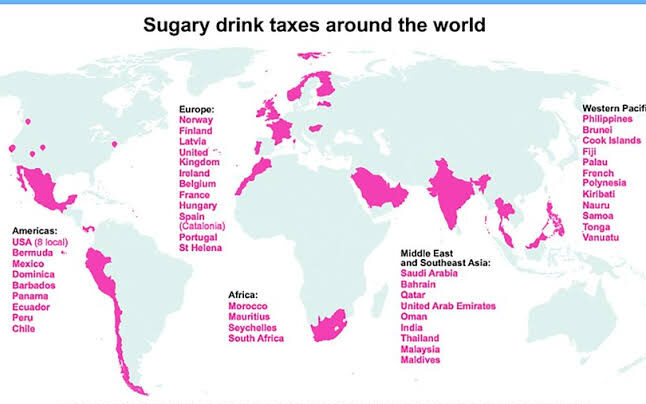

Do you know other countries that have imposed such taxes? Over 40 countries across the globe have implemented some form of sugar levy or tax. The first sugar-related tax was implemented in Hungary in 2011, closely followed by France in 2012.

Let’s talk about the Sugar tax in Nigeria! Does the Ministry of Finance love you so much that they want you to reduce your sugar intake, or do they want you to fund Nigeria’s budget when you buy that cold Pepsi?

Health or Revenue Benefits?

A sugar tax is a levy imposed on goods with high sugar content to reduce added sugar consumption; it is known as The Soft Drinks Industry Levy. It is often introduced as part of a wider strategy to tackle the rise in public health problems such as childhood obesity, diabetes, and tooth decay. A recent meta-analysis reported that approximately 5.8 percent – about 6 million adults in Nigeria live with Diabetes.

This tax is needed to be accompanied by a political leadership scheme that prioritises health above the profit that will be accrued; it holds the benefit of improving the diets of children and preventing obesity. However, there is also a disadvantage attached: the tax is regressive – it makes poorer people pay a larger share of their limited income than the upper class.

The sugar tax in Nigeria is an excise duty of N10($0.02) per litre imposed on all non-alcoholic carbonated and sweetened beverages. This new sugar tax is introduced to raise excise duties and revenue for health-related issues and other critical expenditures, aligning with the 2022 budget priorities. The rationale behind the imposition in Nigeria is to generate more revenue – particularly for the health sector and tackle the obesity and diabetes menace in Nigeria. It is noteworthy that the sugar tax has been in consideration since the beginning of 2021 but was finally signed as a provision in the newly enacted Finance Act for the 2022 fiscal year.

Many believe that the Government did not consider the situation in Nigeria; a bottle of Coke/Pepsi presently is sold at N150. No one knows how companies will react to this law per price and production level. Others argue – including the Nigerian Customs Service that it will reduce the percentage of health-related effects of sugar in Nigeria and increase the government’s revenue intake. The National Union of Food, Beverage, and Tobacco Employees asserts that the imposition of excise duty on these companies would lead to no choice but to lay off workers. It is to be further pointed out that companies would subsequently rather reduce production lines rather than expand.

It is projected that the industry and sectors affected by the Sugar Tax will lose N1.9 trillion in sales revenue due to the tax’s imposition and adverse effects on jobs and supply chain businesses.

The taxation of sugary drinks is an effective intervention to reduce the consumption of sugar and sugar-related health ailments. Still, with the current situation of Nigeria, it is at the cost of the manufacturing company. Manufacturing companies will be affected, as well as the citizens, because the purchasing power is low. The fiscal policies implemented and the additional taxes imposed by the government are good and valid, but the economic realities in Nigeria are not often considered, which makes such policies/laws badly designed. The imposition of additional taxes in Nigeria is often at the cost of more economic pains, with more than 40 percent of Nigerians living below the poverty line.

Conclusion

As early as the late 18th century, the pioneering political economist and social philosopher Adam Smith, deemed sugar, rum, and tobacco to be commodities that are nowhere necessaries of life and are becoming objects of almost universal consumption, making them extremely proper subjects of taxation.

Taxbulary

- Excise Tax – A tax levied on a particular product at the point of manufacture. It can either be: Specific: based on the quantity i.e. volume/ sugar content percent Ad valorem: it is calculated based on the percentage of wholesale or retail price.

- Value-added Tax – a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to point of sales.